Multiple Choice

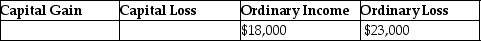

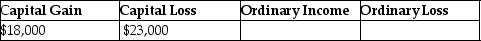

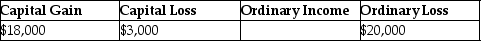

Jeremy has $18,000 of Section 1231 gains and $23,000 of Section 1231 losses.The gains and losses are characterized as

A)

B)

C)

D)

Correct Answer:

Verified

Correct Answer:

Verified

Related Questions

Q2: In order to be considered Sec.1231 property,all

Q8: The following gains and losses pertain to

Q24: Emma owns a small building ($120,000 basis

Q40: During the current year,a corporation sells equipment

Q59: Sec.1231 property must satisfy a holding period

Q72: Sec.1245 can increase the amount of gain

Q86: Pierce has a $16,000 Section 1231 loss,a

Q91: During the current year,George recognizes a $30,000

Q97: Why did Congress establish favorable treatment for

Q109: Hilton,a single taxpayer in the 28% marginal