Multiple Choice

Daniel recognizes $35,000 of Sec.1231 gains and $25,000 of Sec.1231 losses during the current year.The only other Sec.1231 item was a $4,000 loss three years ago.This year,Daniel must report

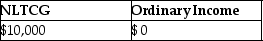

A)

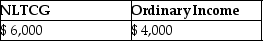

B)

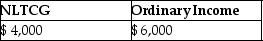

C)

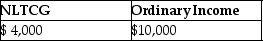

D)

Correct Answer:

Verified

Correct Answer:

Verified

Related Questions

Q2: In order to be considered Sec.1231 property,all

Q12: Lucy,a noncorporate taxpayer,experienced the following Section 1231

Q16: Julie sells her manufacturing plant and land

Q19: The following gains and losses pertain to

Q34: A net Sec.1231 gain is treated as

Q48: Gifts of appreciated depreciable property may trigger

Q79: The amount recaptured as ordinary income under

Q94: Costs of tangible personal business property which

Q97: Why did Congress establish favorable treatment for

Q1719: What is the purpose of Sec. 1245