Essay

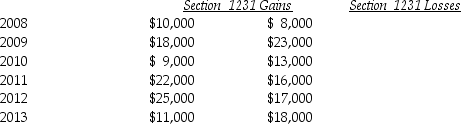

Lucy,a noncorporate taxpayer,experienced the following Section 1231 gains and losses during the years 2008 through 2013.Her first disposition of a Sec.1231 asset occurred in 2008.Assuming Lucy had no capital gains and losses during that time period,what is the tax treatment in each of the years listed?

Correct Answer:

Verified

Correct Answer:

Verified

Q2: In order to be considered Sec.1231 property,all

Q8: The following gains and losses pertain to

Q15: Daniel recognizes $35,000 of Sec.1231 gains and

Q16: Julie sells her manufacturing plant and land

Q34: A net Sec.1231 gain is treated as

Q40: During the current year,a corporation sells equipment

Q72: Sec.1245 can increase the amount of gain

Q79: The amount recaptured as ordinary income under

Q94: Costs of tangible personal business property which

Q97: Why did Congress establish favorable treatment for