Essay

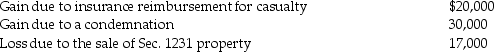

The following are gains and losses recognized in 2013 on Ann's business assets that were held for more than one year.The assets qualify as Sec.1231 property.

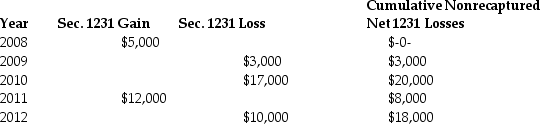

A summary of Ann's net Sec.1231 gains and losses for the previous five-year period is as follows:

A summary of Ann's net Sec.1231 gains and losses for the previous five-year period is as follows:

Describe the specific tax treatment of each of the current year transactions.

Describe the specific tax treatment of each of the current year transactions.

Correct Answer:

Verified

The $20,000 gain from the casualty is tr...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q27: When appreciated property is transferred at death,the

Q28: With respect to residential rental property<br>A)80% or

Q35: With regard to noncorporate taxpayers,all of the

Q38: Marta purchased residential rental property for $600,000

Q46: A taxpayer purchased a factory building in

Q52: If a taxpayer has gains on Sec.1231

Q57: In 1980,Mr.Lyle purchased a factory building to

Q71: Clarise bought a building three years ago

Q92: An unincorporated business sold two warehouses during

Q113: During the current year,Danika recognizes a $30,000