Essay

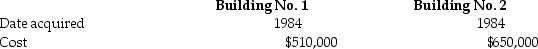

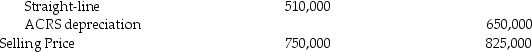

An unincorporated business sold two warehouses during the current year.The straight-line depreciation method was used for Building No.1 and the accelerated method (ACRS)was used for Building No.2.Information about those buildings is presented below.

Accum.Depreciation

Accum.Depreciation

How much gain from these sales should be reported as section 1231 gain and ordinary income due to depreciation recapture?

How much gain from these sales should be reported as section 1231 gain and ordinary income due to depreciation recapture?

Correct Answer:

Verified

Building No.2 is con...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q17: All of the following statements are true

Q27: When appreciated property is transferred at death,the

Q28: With respect to residential rental property<br>A)80% or

Q35: With regard to noncorporate taxpayers,all of the

Q46: A taxpayer purchased a factory building in

Q52: If a taxpayer has gains on Sec.1231

Q57: In 1980,Mr.Lyle purchased a factory building to

Q82: Sec.1245 ordinary income recapture can apply to

Q95: The following are gains and losses recognized

Q113: During the current year,Danika recognizes a $30,000