Essay

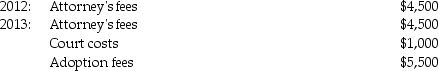

Tyler and Molly,who are married filing jointly with $200,000 of AGI in 2013,incurred the following expenses in their efforts to adopt a child:

The adoption was finalized in 2013.What is the amount of the allowable adoption credit in 2013?

The adoption was finalized in 2013.What is the amount of the allowable adoption credit in 2013?

Correct Answer:

Verified

Qualifying expense:

Less upper income...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

Less upper income...

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q10: Self-employed individuals are subject to the self-employment

Q57: Medical expenses in excess of 10% of

Q58: George and Meredith who are married,have a

Q59: Lee and Whitney incurred qualified adoption expenses

Q61: Jake and Christina are married and file

Q62: Hong earns $127,300 in her job as

Q64: The general business credit is a refundable

Q65: Tom and Anita are married,file a joint

Q79: Bonjour Corp.is a U.S.-based corporation with operations

Q93: Joe,who is single with modified AGI of