Essay

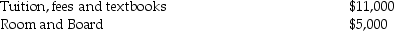

Tom and Anita are married,file a joint return with an AGI of $165,000,and have one dependent child,Tim,who is a first-time freshman in college.The following expenses are incurred and paid in 2013:

What is the maximum education credit allowed to Tom and Anita?

What is the maximum education credit allowed to Tom and Anita?

Correct Answer:

Verified

Tim is eligible for the American Opportu...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q5: Carlotta,Inc. ,has $50,000 foreign-source income and $150,000

Q28: Carlotta,Inc. ,has $50,000 foreign-source income and $150,000

Q55: In computing AMTI,tax preference items are<br>A)excluded.<br>B)added only.<br>C)subtracted

Q57: Medical expenses in excess of 10% of

Q60: Tyler and Molly,who are married filing jointly

Q61: Jake and Christina are married and file

Q62: Hong earns $127,300 in her job as

Q64: The general business credit is a refundable

Q69: Annie has taxable income of $100,000,a regular

Q70: Jeffery and Cassie,who are married with modified