Multiple Choice

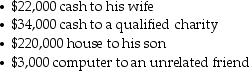

Paul makes the following property transfers in the current year:  The total of Paul's taxable gifts,assuming he does not elect gift splitting with his spouse,subject to the unified transfer tax is

The total of Paul's taxable gifts,assuming he does not elect gift splitting with his spouse,subject to the unified transfer tax is

A) $206,000.

B) $214,000.

C) $234,000.

D) $279,000.

Correct Answer:

Verified

Correct Answer:

Verified

Q3: AB Partnership earns $500,000 in the current

Q32: Sarah contributes $25,000 to a church.Sarah's marginal

Q41: Chris,a single taxpayer,had the following income and

Q47: Latashia reports $100,000 of gross income on

Q54: Which of the following is not an

Q59: The unified transfer tax system,comprised of the

Q80: All states impose a state income tax

Q94: Larry and Ally are married and file

Q951: Describe the components of tax practice.

Q1006: Describe the nondeductible penalties imposed upon taxpayers