Essay

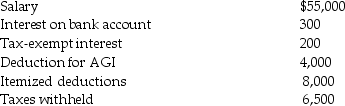

Chris,a single taxpayer,had the following income and deductions during 2014:

Calculate Chris's tax liability due or refund for 2014.

Calculate Chris's tax liability due or refund for 2014.

Correct Answer:

Verified

Tax $5,081.25 + .25(39,350 - ...

Tax $5,081.25 + .25(39,350 - ...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Related Questions

Q3: AB Partnership earns $500,000 in the current

Q30: Dividends paid from most U.S.corporations are taxed

Q32: Sarah contributes $25,000 to a church.Sarah's marginal

Q45: Paul makes the following property transfers in

Q54: Which of the following is not an

Q57: Limited liability companies may elect to be

Q72: All of the following are executive (administrative)sources

Q86: Which of the following steps,related to a

Q94: Larry and Ally are married and file

Q951: Describe the components of tax practice.