Multiple Choice

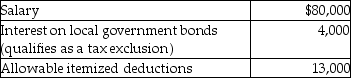

A single taxpayer provided the following information for 2014:  What is taxable income?

What is taxable income?

A) $57,050

B) $63,050

C) $63,000

D) $67,050

Correct Answer:

Verified

Correct Answer:

Verified

Related Questions

Q16: Ryan and Edith file a joint return

Q51: A child credit is a partially refundable

Q58: Adam attended college for much of 2014,during

Q59: Cheryl is claimed as a dependent on

Q60: Mia is a single taxpayer with projected

Q64: Vincent,age 12,is a dependent of his parents.During

Q67: Kelsey is a cash-basis,calendar-year taxpayer.Her salary is

Q68: The following information for 2014 relates to

Q824: Discuss why Congress passed the innocent spouse

Q1519: When two or more people qualify to