Essay

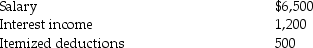

The following information for 2014 relates to Emma Grace,a single taxpayer,age 18:

a.Compute Emma Grace's taxable income assuming she is self-supporting.

a.Compute Emma Grace's taxable income assuming she is self-supporting.

b.Compute Emma Grace's taxable income assuming she is a dependent of her parents.

Correct Answer:

Verified

Correct Answer:

Verified

Q16: Ryan and Edith file a joint return

Q53: Avi and Rianna are considering marriage before

Q63: A single taxpayer provided the following information

Q64: Vincent,age 12,is a dependent of his parents.During

Q67: Kelsey is a cash-basis,calendar-year taxpayer.Her salary is

Q86: Which of the following dependent relatives does

Q91: All of the following items are generally

Q102: The standard deduction is the maximum amount

Q108: To qualify as an abandoned spouse,the taxpayer

Q824: Discuss why Congress passed the innocent spouse