Multiple Choice

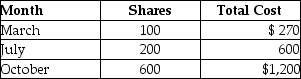

Edward purchased stock last year as follows:  In April of this year,Edward sells 80 shares for $250.Edward cannot specifically identify the stock sold.The basis for the 80 shares sold is

In April of this year,Edward sells 80 shares for $250.Edward cannot specifically identify the stock sold.The basis for the 80 shares sold is

A) $160.

B) $184.

C) $216.

D) $240.

Correct Answer:

Verified

Correct Answer:

Verified

Related Questions

Q11: Five different capital gain tax rates could

Q28: On January 31 of this year,Jennifer pays

Q33: In 2011 Toni purchased 100 shares of

Q43: Monte inherited 1,000 shares of Corporation Zero

Q43: This year,Lauren sold several shares of stock

Q64: Unlike an individual taxpayer,the corporate taxpayer does

Q78: Kathleen received land as a gift from

Q81: Jordan paid $30,000 for equipment two years

Q94: Jessica owned 200 shares of OK Corporation

Q130: Net long-term capital gains receive preferential tax