Multiple Choice

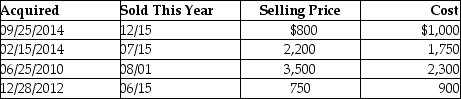

This year,Lauren sold several shares of stock held for investment.The following is a summary of her capital transactions for 2014:  What are the amounts of Lauren's capital gains (losses) for this year?

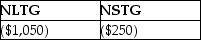

What are the amounts of Lauren's capital gains (losses) for this year?

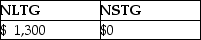

A)

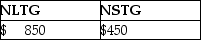

B)

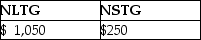

C)

D)

Correct Answer:

Verified

Correct Answer:

Verified

Related Questions

Q28: On January 31 of this year,Jennifer pays

Q38: Edward purchased stock last year as follows:

Q43: Monte inherited 1,000 shares of Corporation Zero

Q44: Renee is single and has taxable income

Q47: On July 25,2013,Karen gives stock with a

Q48: Margaret died on September 16,2014,when she owned

Q64: Unlike an individual taxpayer,the corporate taxpayer does

Q71: Terrell and Michelle are married and living

Q130: Net long-term capital gains receive preferential tax

Q751: What type of property should be transferred