Multiple Choice

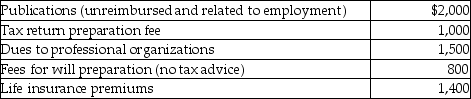

West's adjusted gross income was $90,000.During the current year he incurred and paid the following:  Assuming he can itemize deductions,how much should West claim as miscellaneous itemized deductions (after limitations have been applied) ?

Assuming he can itemize deductions,how much should West claim as miscellaneous itemized deductions (after limitations have been applied) ?

A) $2,700

B) $4,500

C) $3,500

D) $5,300

Correct Answer:

Verified

Correct Answer:

Verified

Q16: Educational expenses incurred by a bookkeeper for

Q25: Educational expenses incurred by a CPA for

Q38: Deductible moving expenses include the cost of

Q42: Travel expenses for a taxpayer's spouse are

Q77: Travel expenses related to temporary work assignments

Q122: Gwen traveled to New York City on

Q122: Bill obtained a new job in Boston.He

Q125: Sam retired last year and will receive

Q128: Tyler (age 50)and Connie (age 48)are a

Q129: Edward incurs the following moving expenses: <img