Multiple Choice

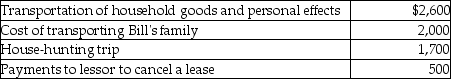

Bill obtained a new job in Boston.He incurred the following moving expenses:  Assuming Bill is entitled to deduct moving expenses,what is the amount of the deduction?

Assuming Bill is entitled to deduct moving expenses,what is the amount of the deduction?

A) $2,600

B) $4,600

C) $6,300

D) $6,800

Correct Answer:

Verified

Correct Answer:

Verified

Related Questions

Q15: What factors are considered in determining whether

Q15: Kim currently lives in Buffalo and works

Q31: Which of the following is true about

Q42: Travel expenses for a taxpayer's spouse are

Q77: Travel expenses related to temporary work assignments

Q118: Richard traveled from New Orleans to New

Q122: Gwen traveled to New York City on

Q125: Sam retired last year and will receive

Q127: West's adjusted gross income was $90,000.During the

Q641: If an employee incurs travel expenditures and