Multiple Choice

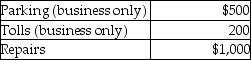

Brittany,who is an employee,drove her automobile a total of 20,000 business miles in 2014.This represents about 75% of the auto's use. She has receipts as follows:  Brittany's AGI for the year of $50,000,and her employer does not provide any reimbursement.She uses the standard mileage rate method. After application of any relevant floors or other limitations,Brittany can deduct

Brittany's AGI for the year of $50,000,and her employer does not provide any reimbursement.She uses the standard mileage rate method. After application of any relevant floors or other limitations,Brittany can deduct

A) $10,900.

B) $11,900.

C) $10,750.

D) $12,900.

Correct Answer:

Verified

Correct Answer:

Verified

Q15: Kim currently lives in Buffalo and works

Q15: What factors are considered in determining whether

Q26: In a defined contribution pension plan,fixed amounts

Q31: Which of the following is true about

Q44: SIMPLE retirement plans allow a higher level

Q63: A nondeductible floor of 2% of AGI

Q112: Feng,a single 40 year old lawyer,is covered

Q116: David acquired an automobile for $30,000 for

Q118: Richard traveled from New Orleans to New

Q1643: Johanna is single and self- employed as