Essay

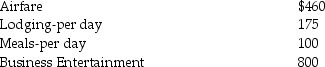

Richard traveled from New Orleans to New York for both business and vacation.He spent 4 days conducting business and some days vacationing.He incurred the following expenses:

What is his miscellaneous itemized deduction (before the floor),assuming Richard is an employee and is not reimbursed,under the following two circumstances?

What is his miscellaneous itemized deduction (before the floor),assuming Richard is an employee and is not reimbursed,under the following two circumstances?

a.He spends three days on vacation,in addition to the business days.

b.He spends six days on vacation,in addition to the business days.

Correct Answer:

Verified

Correct Answer:

Verified

Q15: Kim currently lives in Buffalo and works

Q15: What factors are considered in determining whether

Q31: Which of the following is true about

Q42: Travel expenses for a taxpayer's spouse are

Q44: SIMPLE retirement plans allow a higher level

Q115: Brittany,who is an employee,drove her automobile a

Q116: David acquired an automobile for $30,000 for

Q122: Bill obtained a new job in Boston.He

Q641: If an employee incurs travel expenditures and

Q1643: Johanna is single and self- employed as