Multiple Choice

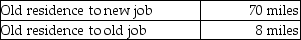

Donald takes a new job and moves to a new residence.The distances are as follows:  By how many miles does the move exceed the minimum distance requirement for the moving expense deduction?

By how many miles does the move exceed the minimum distance requirement for the moving expense deduction?

A) 12 miles

B) 20 miles

C) 62 miles

D) none of the above

Correct Answer:

Verified

Correct Answer:

Verified

Q6: Characteristics of profit-sharing plans include all of

Q9: Rita,a single employee with AGI of $100,000

Q11: The maximum tax deductible contribution to a

Q15: Ellie,a CPA,incurred the following deductible education expenses

Q16: A contributor may make a deductible contribution

Q39: Wilson Corporation granted an incentive stock option

Q103: Chuck, who is self- employed, is scheduled

Q131: When a public school system requires advanced

Q147: Allison,who is single,incurred $4,000 for unreimbursed employee

Q151: If an employee incurs business-related entertainment expenses