Essay

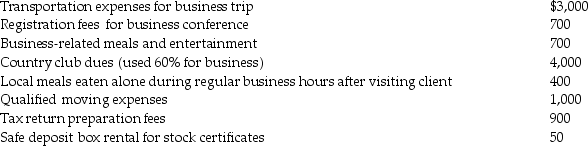

Rita,a single employee with AGI of $100,000 before consideration of the items below,incurred the following expenses during the year,all of which were unreimbursed unless otherwise indicated:

In addition,Rita paid $300 for dues to her professional business association. The company reimbursed her after she submitted the appropriate documentation. What is Rita's net miscellaneous itemized deduction for the year after application of all relevant limitations?

In addition,Rita paid $300 for dues to her professional business association. The company reimbursed her after she submitted the appropriate documentation. What is Rita's net miscellaneous itemized deduction for the year after application of all relevant limitations?

Correct Answer:

Verified

The country club dues are not...

The country club dues are not...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q6: Martin Corporation granted a nonqualified stock option

Q6: Characteristics of profit-sharing plans include all of

Q11: The maximum tax deductible contribution to a

Q13: Donald takes a new job and moves

Q23: Josiah is a human resources manager of

Q29: Which of the following statements is incorrect

Q52: Which statement is correct regarding SIMPLE retirement

Q131: When a public school system requires advanced

Q147: Allison,who is single,incurred $4,000 for unreimbursed employee

Q151: If an employee incurs business-related entertainment expenses