Multiple Choice

Martin Corporation granted a nonqualified stock option to employee Caroline on January 1,2011. The option price was $150,and the FMV of the Martin stock was also $150 on the grant date.The option allowed Caroline to purchase 1,000 shares of Martin stock. The option itself does not have a readily ascertainable FMV. Caroline exercised the option on August 1,2014 when the stock's FMV was $250.If Caroline sells the stock on September 5,2015 for $300 per share,she must recognize

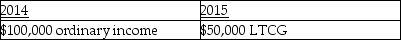

A)

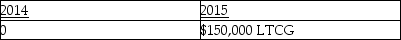

B)

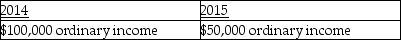

C)

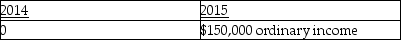

D)

Correct Answer:

Verified

Correct Answer:

Verified

Q9: Rita,a single employee with AGI of $100,000

Q11: The maximum tax deductible contribution to a

Q23: Josiah is a human resources manager of

Q29: Which of the following statements is incorrect

Q52: Which statement is correct regarding SIMPLE retirement

Q56: Transportation expenses incurred to travel from one

Q97: Matt is a sales representative for a

Q131: When a public school system requires advanced

Q151: If an employee incurs business-related entertainment expenses

Q1370: Commuting to and from a job location