Essay

Everest Corp.acquires a machine (seven-year property)on January 10,2014 at a cost of $212,000.Everest makes the election to expense the maximum amount under Sec.179.

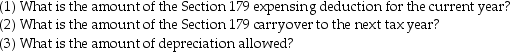

a.Assume that the taxable income from trade or business is $500,000.

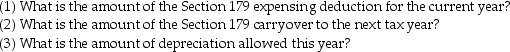

b.Assume instead that the taxable income from trade or business is $10,000.

b.Assume instead that the taxable income from trade or business is $10,000.

Correct Answer:

Verified

Correct Answer:

Verified

Q8: On January 1,2014,Charlie Corporation acquires all of

Q11: On May 1,2008,Empire Properties Corp.,a calendar year

Q15: Greta,a calendar-year taxpayer,acquires 5-year tangible personal property

Q27: A taxpayer owns an economic interest in

Q37: In computing MACRS depreciation in the year

Q40: Under the MACRS rules,salvage value is not

Q45: Under the MACRS system,if the aggregate basis

Q47: Taxpayers are entitled to a depletion deduction

Q50: Under the MACRS system,automobiles and computers are

Q73: Galaxy Corporation purchases specialty software from a