Essay

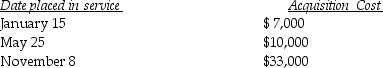

Greta,a calendar-year taxpayer,acquires 5-year tangible personal property in 2014 and places the property in service on the following schedule:

Greta elects to expense the maximum under Section 179,and selects the property placed into service on November 8.Her business 's taxable income before section 179 is $190,000.What is the total cost recovery deduction (depreciation and Sec.179)for 2014?

Greta elects to expense the maximum under Section 179,and selects the property placed into service on November 8.Her business 's taxable income before section 179 is $190,000.What is the total cost recovery deduction (depreciation and Sec.179)for 2014?

Correct Answer:

Verified

Because Sec.179 expensing is ...

Because Sec.179 expensing is ...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q11: On May 1,2008,Empire Properties Corp.,a calendar year

Q13: Everest Corp.acquires a machine (seven-year property)on January

Q27: A taxpayer owns an economic interest in

Q37: In computing MACRS depreciation in the year

Q40: Under the MACRS rules,salvage value is not

Q45: Under the MACRS system,if the aggregate basis

Q50: Under the MACRS system,automobiles and computers are

Q73: Galaxy Corporation purchases specialty software from a

Q85: Off-the-shelf computer software that is purchased for

Q1256: Why would a taxpayer elect to use