Essay

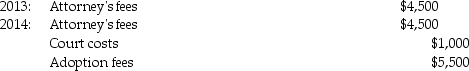

Tyler and Molly,who are married filing jointly with $210,000 of AGI in 2014,incurred the following expenses in their efforts to adopt a child:

The adoption was finalized in 2014.What is the amount of the allowable adoption credit in 2014?

The adoption was finalized in 2014.What is the amount of the allowable adoption credit in 2014?

Correct Answer:

Verified

Qualifying expense:  Less upper income p...

Less upper income p...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q1: The earned income credit is available only

Q7: The adoption credit based on qualified adoption

Q30: The health insurance premium assistance credit is

Q33: Lara started a self-employed consulting business in

Q34: Tom and Anita are married,file a joint

Q36: ChocoHealth Inc.is developing new chocolate products providing

Q38: Suzanne,a single taxpayer,has the following tax information

Q40: Lee and Whitney incurred qualified adoption expenses

Q41: With respect to estimated tax payments for

Q61: All tax-exempt bond interest income is classified