Essay

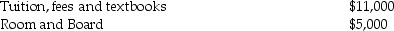

Tom and Anita are married,file a joint return with an AGI of $165,000,and have one dependent child,Tim,who is a first-time freshman in college.The following expenses are incurred and paid in 2014:

What is the maximum education credit allowed to Tom and Anita?

What is the maximum education credit allowed to Tom and Anita?

Correct Answer:

Verified

Tim is eligible for the American Opportu...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q1: The earned income credit is available only

Q7: The adoption credit based on qualified adoption

Q17: The child and dependent care credit provides

Q30: The health insurance premium assistance credit is

Q33: Lara started a self-employed consulting business in

Q35: Tyler and Molly,who are married filing jointly

Q36: ChocoHealth Inc.is developing new chocolate products providing

Q38: Suzanne,a single taxpayer,has the following tax information

Q41: With respect to estimated tax payments for

Q61: All tax-exempt bond interest income is classified