Multiple Choice

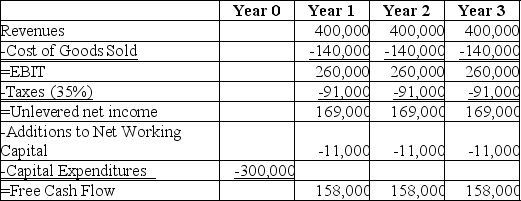

Use the table for the question(s) below.

-Visby Rides,a livery car company,is considering buying some new luxury cars.After extensive research,they come up with the above estimates of free cash flow from this project.By how much could the discount rate rise before the net present value (NPV) of this project is zero,given that it is currently 10%?

A) by 17%

B) by 22%

C) by 25%

D) by 27%

E) by 30%

Correct Answer:

Verified

Correct Answer:

Verified

Q2: Use the table for the question(s)below.<br> <img

Q3: Why does the Canada Revenue Agency (CRA)have

Q4: CathFoods will release a new range of

Q5: The ultimate goal of capital budgeting is

Q6: What is the ultimate goal of capital

Q7: Which of the following will cause the

Q8: Which of the following best describes why

Q10: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB6725/.jpg" alt=" Cromwell Industries is

Q11: A textile company invests $12 million in

Q34: How do we handle interest expense when