Multiple Choice

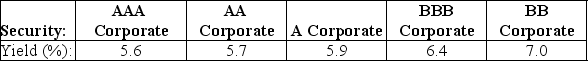

A mining company needs to raise $100 million in order to begin open pit mining of a coal seam.The company will fund this by issuing 30-year bonds with a face value of $1000 and a coupon rating of 6%,paid annually.The above table shows the yield to maturity for similar 30-year corporate bonds of different ratings.If the mining company's bonds receive a A rating,what will be their selling price?

A mining company needs to raise $100 million in order to begin open pit mining of a coal seam.The company will fund this by issuing 30-year bonds with a face value of $1000 and a coupon rating of 6%,paid annually.The above table shows the yield to maturity for similar 30-year corporate bonds of different ratings.If the mining company's bonds receive a A rating,what will be their selling price?

A) $947.22

B) $967.64

C) $1013.91

D) $1016.41

E) $875.91

Correct Answer:

Verified

Correct Answer:

Verified

Q84: Use the information for the question(s)below.<br>Luther Industries

Q85: Why do bond prices fall as interest

Q86: Consider a zero-coupon bond with $1,000 face

Q87: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB6725/.jpg" alt=" The yields to

Q90: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB6725/.jpg" alt=" The above table

Q91: Consider a zero-coupon bond with a $1000

Q92: Use the table for the question(s)below.<br>Consider the

Q93: Use the information for the question(s)below.<br>Luther Industries

Q94: A $5000 bond with a coupon rate

Q95: Bond traders generally quote bond yields rather