Multiple Choice

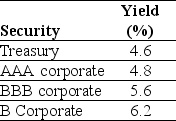

Use the table for the question(s) below.

Consider the following yields to maturity on various one-year zero-coupon securities:

- The price (expressed as a percentage of the face value) of a one-year,zero-coupon,corporate bond with a BBB rating is closest to:

The price (expressed as a percentage of the face value) of a one-year,zero-coupon,corporate bond with a BBB rating is closest to:

A) 95.60

B) 94.16

C) 95.42

D) 94.70

E) 95.10

Correct Answer:

Verified

Correct Answer:

Verified

Q87: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB6725/.jpg" alt=" The yields to

Q89: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB6725/.jpg" alt=" A mining company

Q90: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB6725/.jpg" alt=" The above table

Q91: Consider a zero-coupon bond with a $1000

Q93: Use the information for the question(s)below.<br>Luther Industries

Q94: A $5000 bond with a coupon rate

Q95: Bond traders generally quote bond yields rather

Q95: Assuming that this bond trades for $903,then

Q96: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB6725/.jpg" alt=" Lloyd Industries raised

Q97: Why are the interest rates of Government