Multiple Choice

Use the table for the question(s) below.

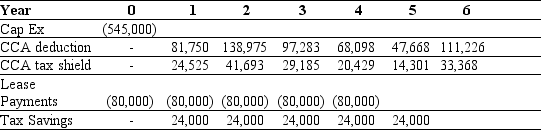

Danby Construction is considering leasing a new crane for the next 5 years.Danby has created the following table of cash flows to help with the decision:

-If Danby's borrowing cost is 9%,and its tax rate is 30%,what is the NPV of leasing versus borrowing?

A) $156,032

B) $175,382

C) $308,968

D) -$363,441

E) $289,618

Correct Answer:

Verified

Correct Answer:

Verified

Q22: Use the information for the question(s)below.<br>Suppose the

Q78: Toronto Trucking has decided to lease a

Q79: Use the table for the question(s)below.<br> <img

Q80: Most leases involve a large upfront payment.

Q81: Suppose that the bulldozer can be leased

Q82: What will Luther's balance sheet look like

Q84: Why do we compare leasing to borrowing

Q85: Explain the reduced resale costs argument for

Q87: A lease where ownership of the asset

Q88: A lease where the lessee can purchase