Multiple Choice

Use the table for the question(s) below.

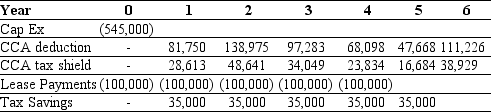

Danby Construction is considering leasing a new crane for the next 5 years.Danby has created the following table of cash flows to help with the decision:

-Danby Construction has decided to lease a new crane for the next 5 years.The purchase price of the crane is $545,000,and the working life of the crane is 10 years.The crane falls under asset class 43 and has a capital cost allowance (CCA) rate of 30%.Assume disposal for $0 at the beginning of year 6.If leased,the annual lease payments will be $80,000 per year for five years,and it is a true tax lease.Assume the tax savings occur at the end of each year.If Danby's borrowing cost is 9%,and its tax rate is 30%,what is the NPV of leasing versus borrowing?

A) $308,968

B) $175,382

C) $289,618

D) $156,032

E) -$98,405

Correct Answer:

Verified

Correct Answer:

Verified

Q30: Use the information for the question(s)below.<br>St.Martin's Hospital

Q52: Harrowfield Deliveries has decided to lease a

Q53: When evaluating a true tax lease,we discount

Q55: Which of the following is a suspect

Q56: A lease that gives the lessee the

Q58: A lease that is designed to obtain

Q59: Use the table for the question(s)below.<br>Luther Industries

Q60: In a perfect capital market,leases neither increase

Q61: Which of the following is a suspect

Q62: Use the table for the question(s)below.<br> <img