Multiple Choice

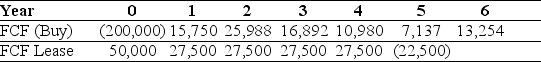

Use the table for the question(s) below.

Your firm is a lessor that is planning to buy some new equipment and offer it to another firm through a lease arrangement.You have calculated the above cash flows for a potential lease you might offer.

Your firm is a lessor that is planning to buy some new equipment and offer it to another firm through a lease arrangement.You have calculated the above cash flows for a potential lease you might offer.

-If your firm's borrowing cost is 12% and the tax rate is 25%,what is the NPV of buying and leasing?

A) $20,479

B) $5,844

C) -$14,694

D) -$5,844

E) $14,694

Correct Answer:

Verified

Correct Answer:

Verified

Q16: Use the table for the question(s)below.<br>Luther Industries

Q57: Use the table for the question(s)below.<br>Danby Construction

Q58: A lease that is designed to obtain

Q59: Use the table for the question(s)below.<br>Luther Industries

Q60: In a perfect capital market,leases neither increase

Q61: Which of the following is a suspect

Q63: A lease in which the lessor borrows

Q64: The monthly lease payments for a four-year

Q65: If a lease contract is characterized as

Q66: To evaluate a lease correctly,the appropriate comparison