Essay

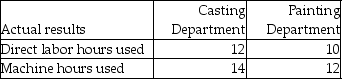

The Sweetheart Corporation uses departmental overhead rates to allocate its manufacturing overhead to jobs. The company has two departments: cutting and painting. The Cutting Department uses a departmental overhead rate of $12 per machine hour, while the Painting Department uses a departmental overhead rate of $17 per direct labor hour. Job 422 used the following direct labor hours and machine hours in the two departments:

The cost for direct labor is $20 per direct labor hour and the cost of the direct materials used by Job 422 is $800.

The cost for direct labor is $20 per direct labor hour and the cost of the direct materials used by Job 422 is $800.

Required: What was the total cost of Job 422 if the Sweetheart Corporation used the departmental overhead rates to allocate manufacturing overhead?

Correct Answer:

Verified

Correct Answer:

Verified

Q142: Costs incurred to detect poor-quality goods and

Q143: Platinum Company manufactures several different products and

Q144: Lucas Industries uses departmental overhead rates to

Q145: Potter & Weasley Company had the following

Q146: The cost of depreciation, insurance, and property

Q148: The costs incurred when poor quality goods

Q149: Alexander Inc. uses activity-based costing. The company

Q150: Facility-level activities and costs are incurred for

Q151: Potter & Weasley Company had the following

Q152: Beartowne Enterprises uses an activity-based costing system