Multiple Choice

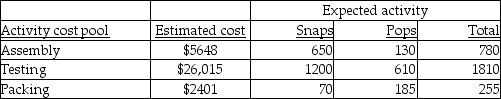

Alexander Inc. uses activity-based costing. The company produces two products: Snaps and Pops. The expected annual production of Snaps is 1700 units, while the expected annual production of Pops is 2400 units. There are three activity cost pools: Assembly, Testing, and Packing. The estimated costs and activities for each of these three activity pools follows:  The cost pool activity rate for Testing would be (Round all answers to two decimal places.)

The cost pool activity rate for Testing would be (Round all answers to two decimal places.)

A) $21.68 per activity.

B) $14.37 per activity.

C) $42.65 per activity.

D) $7.19 per activity.

Correct Answer:

Verified

Correct Answer:

Verified

Q144: Lucas Industries uses departmental overhead rates to

Q145: Potter & Weasley Company had the following

Q146: The cost of depreciation, insurance, and property

Q147: The Sweetheart Corporation uses departmental overhead rates

Q148: The costs incurred when poor quality goods

Q150: Facility-level activities and costs are incurred for

Q151: Potter & Weasley Company had the following

Q152: Beartowne Enterprises uses an activity-based costing system

Q153: The storage of raw materials is considered

Q154: Potter & Weasley Company had the following