Multiple Choice

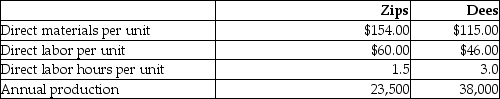

Cross Roads Manufacturing currently uses a traditional costing system. The company allocates overhead to its two products, Zips and Dees, using a predetermined manufacturing overhead rate based on direct labor hours. Here is data related to the company's two products:  Information about the company's estimated manufacturing overhead for the year follows:

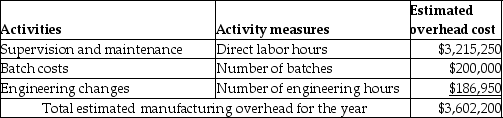

Information about the company's estimated manufacturing overhead for the year follows: Total estimated direct labor hours for the company for the year are 149,250 hours.

Total estimated direct labor hours for the company for the year are 149,250 hours.

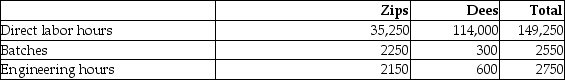

The company is evaluating whether it should use an activity-based costing system in place of its traditional costing system. Additional information about production needed for the activity-based costing system follows: The amount of manufacturing overhead that would be allocated to one unit of Dees using an activity-based costing system would be closest to (Round all answers to two decimal places.)

The amount of manufacturing overhead that would be allocated to one unit of Dees using an activity-based costing system would be closest to (Round all answers to two decimal places.)

A) $94.79

B) $107.24

C) $66.32

D) $40.98

Correct Answer:

Verified

Correct Answer:

Verified

Q118: ABC tends to increase the unit cost

Q119: Beaver Company manufactures coffee tables and uses

Q120: In using an ABC system, all of

Q121: The cost of product liability claims is

Q122: Which of the following cost of quality

Q124: Beaver Company manufactures coffee tables and uses

Q125: Beartowne Enterprises uses an activity-based costing system

Q126: Inspection of incoming raw materials and production

Q127: Swiss Furniture Company manufactures bookshelves and uses

Q128: Unit-level activities and costs are incurred for