Multiple Choice

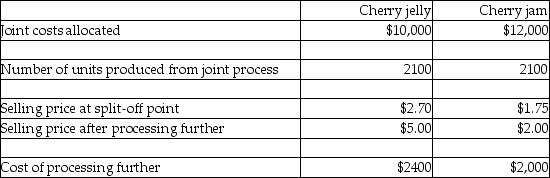

A joint production process at Specialty Jams Farm results in two products, cherry jelly and cherry jam. The following cost and activity data relate to these two products:  Cherry jelly can be sold as-is (at the split-off point) for $2.70 per unit, or it can be processed further into a specialty cherry smoothie and then sold for $5.00 per unit. If cherry jelly is processed further into the specialty cherry smoothie, what would be the overall effect on operating income?

Cherry jelly can be sold as-is (at the split-off point) for $2.70 per unit, or it can be processed further into a specialty cherry smoothie and then sold for $5.00 per unit. If cherry jelly is processed further into the specialty cherry smoothie, what would be the overall effect on operating income?

A) $2430 net decrease in operating income

B) $5670 net decrease in operating income

C) $5670 net increase in operating income

D) $2430 net increase in operating income

Correct Answer:

Verified

Correct Answer:

Verified

Q2: The income statement for Germain Appliances is

Q3: Stoneycreek golf course is planning for the

Q4: Harvey Automobiles uses a standard part in

Q5: Stoneycreek golf course is planning for the

Q6: Zach has the following information to evaluate-his

Q7: An "opportunity cost" is best described by

Q8: Widget Inc. manufactures widgets. The company has

Q9: Buzz Appliances manufactures two products: Food Processors

Q10: The internal financial statements of Vera Incorporated

Q11: Target total cost is defined as<br>A)cost of