Multiple Choice

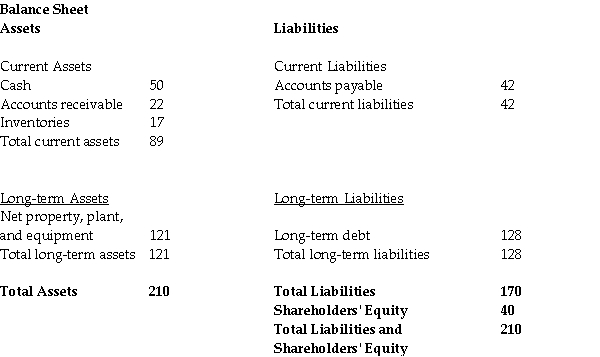

Use the table for the question(s) below.

-Your firm is considering building a new office complex. Your firm already owns land suitable for the new complex. The current book value of the land is $100 000; however, a commercial real estate agent has informed you that an outside buyer interested in purchasing this land would be willing to pay $650 000 for it. When calculating the net present value (NPV) of your new office complex, ignoring taxes, the appropriate incremental cash flow for the use of this land is

A) $100 000.

B) $0.

C) $750 000.

D) $650 000.

Correct Answer:

Verified

Correct Answer:

Verified

Q20: Which of the following best explains why

Q21: Use the figure for the question(s)below. <img

Q22: Use the information for the question(s)below.<br>Epiphany Industries

Q23: Use the table for the question(s)below. <img

Q24: An exploration of the effect of changing

Q26: Use the figure for the question(s)below. <img

Q30: A decrease in the sales of a

Q69: What are project externalities?

Q87: If a business owner is using the

Q91: The most difficult part of the capital