Multiple Choice

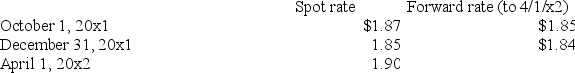

Amazing Corporation, a U.S. enterprise, sold product to a customer in Wales on October 1, 20x1 for £100,000 with payment required on April 1, 20x2. Relevant exchange rates are:  The discount factor corresponding to the company's incremental borrowing rate for 6 months is 0.95.

The discount factor corresponding to the company's incremental borrowing rate for 6 months is 0.95.

Assuming that Amazing Corporation does not hedge this transaction, what is the amount of exchange gain or loss that it should show on its December 31, 2001 income statement?

A) Loss $1,000

B) Loss $2,000

C) Gain $1,000

D) Gain $1,900

Correct Answer:

Verified

Correct Answer:

Verified

Q18: What is the primary difference between a

Q19: Which of the following statements is true

Q20: How should U.S. companies record receivables and

Q21: What kind of exposure exists for recognized

Q22: On November 1, 2001 Zamfir Company, a

Q24: What has occurred when one company arranges

Q25: Which of the following is done when

Q26: What term is used for an option

Q27: Why was there very little fluctuation in

Q28: What is "asset exposure" to foreign exchange