Multiple Choice

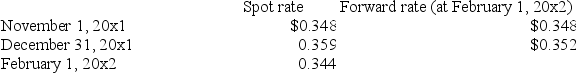

On November 1, 2001 Zamfir Company, a U.S. corporation, purchased minerals from a Russian company for 2,000,000 rubles, payable in 3 months. The relevant exchange rates between the U.S. and Russian currencies are given:  The company's incremental borrowing rate provides a discount rate of 0.975 for three months.

The company's incremental borrowing rate provides a discount rate of 0.975 for three months.

If Zamfir does not attempt to hedge this transaction, what is the gain or loss that should be shown on the company's December 31, 2001 financial statements?

A) $22,000 loss

B) $21,450 loss

C) $8,000 gain

D) $7,800 gain

Correct Answer:

Verified

Correct Answer:

Verified

Q17: When a currency is allowed to increase

Q18: What is the primary difference between a

Q19: Which of the following statements is true

Q20: How should U.S. companies record receivables and

Q21: What kind of exposure exists for recognized

Q23: Amazing Corporation, a U.S. enterprise, sold product

Q24: What has occurred when one company arranges

Q25: Which of the following is done when

Q26: What term is used for an option

Q27: Why was there very little fluctuation in