Multiple Choice

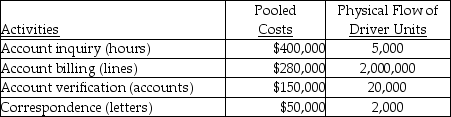

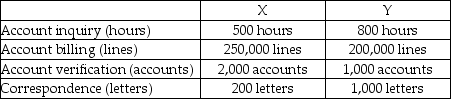

Use the information below to answer the following question(s) .Bill Cobb Corporation had the following activities, pooled costs, and physical flow of driver units.The company uses activity-based costing.  The above activities are used by departments X and Y as follows:

The above activities are used by departments X and Y as follows:

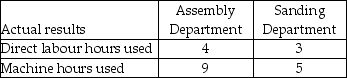

-Babcock Industries uses departmental overhead rates to allocate its manufacturing overhead to jobs.The company has two departments: Assembly and Sanding.The Assembly Department uses a departmental overhead rate of $20 per machine hour, while the Sanding Department uses a departmental overhead rate of $15 per direct labour hour.Job 396 used the following direct labour hours and machine hours in the two departments:  The cost for direct labour is $25 per direct labour hour and the cost of the direct materials used by Job 396 is $1,200.What was the total cost of Job 396 if Babcock Industries used the departmental overhead rates to allocate manufacturing overhead?

The cost for direct labour is $25 per direct labour hour and the cost of the direct materials used by Job 396 is $1,200.What was the total cost of Job 396 if Babcock Industries used the departmental overhead rates to allocate manufacturing overhead?

A) $1,375

B) $1,425

C) $1,500

D) $1,600

E) $1,630

Correct Answer:

Verified

Correct Answer:

Verified

Q16: A division of a company manufactures two

Q17: Answer the following question(s)using the information below.Wallace

Q18: The use of a single indirect cost

Q19: Which of the following is NOT an

Q20: Which of the following does not characterize

Q22: Rogers Printing Ltd.has contracts to complete weekly

Q23: Using a broad average to assign costs

Q24: An ABC system results in a better

Q25: Use the information below to answer the

Q26: Provided a single allocation base is used,