Essay

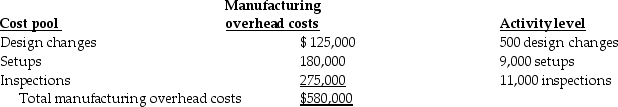

Rogers Printing Ltd.has contracts to complete weekly supplements required by its' customers.For the current year, manufacturing overhead cost estimates total $580,000 for an annual production capacity of 14,500,000 pages.Rogers Printing decided to evaluate the use of additional cost pools.After analyzing manufacturing overhead costs, it was determined that number of design changes, setups, and inspections are the primary manufacturing overhead cost drivers.The following information was gathered during the analysis:

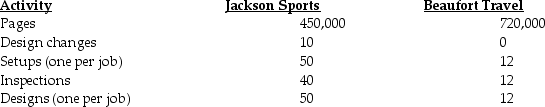

Two customers, Jackson Sports and Beaufort Travel, are expected to use the following printing services:

Two customers, Jackson Sports and Beaufort Travel, are expected to use the following printing services:

Pages are a direct cost at $0.02 per page.Design costs per job average $1,500 and $1,700 for Jackson Sports and Beaufort Travel, respectively.Rogers Printing sets prices at $0.11 per page plus 120% of design costs.Assume that all costs are variable.Required:

Pages are a direct cost at $0.02 per page.Design costs per job average $1,500 and $1,700 for Jackson Sports and Beaufort Travel, respectively.Rogers Printing sets prices at $0.11 per page plus 120% of design costs.Assume that all costs are variable.Required:

Prepare income statements in contribution margin format for both customers using:

a.Traditional (simple)costing with overhead applied on a page capacity basis

b.Activity-based costing

c.How much a page should Jackson Sports be charged if Rogers Printing wants to breakeven on this customer? Assume that manufacturing overhead costs are fixed and that they are allocated to customers based on pages sold as a percentage of production capacity; and, that design costs are also fixed.

Correct Answer:

Verified

Traditional costing overhead rate = $336...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q17: Answer the following question(s)using the information below.Wallace

Q18: The use of a single indirect cost

Q19: Which of the following is NOT an

Q20: Which of the following does not characterize

Q21: Use the information below to answer the

Q23: Using a broad average to assign costs

Q24: An ABC system results in a better

Q25: Use the information below to answer the

Q26: Provided a single allocation base is used,

Q27: Product-cost cross-subsidization means that if a company