Essay

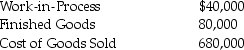

Moira Company has just finished its first year of operations and must decide which method to use for adjusting cost of goods sold.The company used a budgeted indirect-cost rate for its manufacturing operations.The amount that was allocated ($435,000)to cost of goods sold was different from the actual amount incurred ($425,000).These were the respective ending balances in the Manufacturing Overhead Allocated and Manufacturing Overhead control accounts.Ending balances in the relevant accounts were:

Required:

Required:

a.Prepare a journal entry to write off the difference between allocated and actual overhead directly to Cost of Goods Sold.Be sure your journal entry closes the related overhead accounts.

b.Prepare a journal entry that prorates the write-off of the difference between allocated and actual overhead using ending account balances.Be sure your journal entry closes the related overhead

accounts.

Correct Answer:

Verified

Correct Answer:

Verified

Q73: Professional Recruiting provides recruiting consulting services to

Q74: What is the purpose of subsidiary ledgers?

Q75: Schulz Corporation applies overhead based upon machine-hours.Budgeted

Q76: Hogan Corporation applies overhead based upon machine-hours.Budgeted

Q77: Cost pools are defined as groupings of

Q79: A company employs 25 full-time staff.The company

Q80: Answer the following question(s)using the information below.Cloudy

Q81: The main advantage of using budgeted cost

Q82: Last week Job # WPP 298 was

Q83: Valley Manufacturing uses departmental cost driver rates