Essay

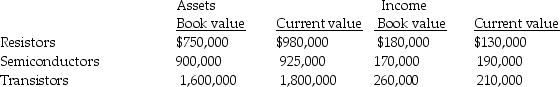

Holmes Electronics Ltd.has three divisions: Resistors, Semiconductors and Transistors, each located in a different geographic region.Data for its most recent year are presented below:

The company is currently using a required rate of return of 16 percent.Required:

The company is currently using a required rate of return of 16 percent.Required:

a.Compute the ROI using both book value and current value for all divisions.Round to four decimal places.

b.Compute residual income using book value and current value for all divisions.

c.Does book value or current value provide the better basis for performance evaluation? Why? Which division is the most successful?

Correct Answer:

Verified

a.Book value ROI: Resistors = $180,000/$...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q2: Answer the following question(s)using the information below:<br>Coldbrook

Q3: Hargrave Products has three divisions which operate

Q4: Which of the following is NOT a

Q5: Stratton Industries has two divisions.These divisions reported

Q6: Which of the following statements is TRUE

Q8: Use the information below to answer the

Q9: Answer the following question(s)using the information below:<br>Springfield

Q10: A multinational corporation established a division in

Q12: Use the information below to answer the

Q51: The three alternatives for increasing return on