Essay

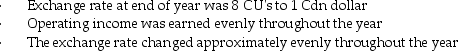

A multinational corporation established a division in a South American country as a subsidiary corporation, with an initial investment in total assets of 13 million CU's (the local currency is CU's), which cost the company $3,250,000 Canadian at the time.The company sent an experienced manager to run the division, and gave her a target of 13% required rate of return, promising a bonus if this was met and/or exceeded.After one year, the subsidiary manager was pleased to report a 20% ROI.You have been able to determine the following data pertaining to the subsidiary:

Required:

Required:

a.Calculate the subsidiary's income in CU's.

b.Calculate the subsidiary's return on investment in Canadian dollars.

c.Calculate the subsidiary's residual income in Canadian dollars.

Correct Answer:

Verified

a.income ÷ 13,000,000 CU's = ....View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q5: Stratton Industries has two divisions.These divisions reported

Q6: Which of the following statements is TRUE

Q7: Holmes Electronics Ltd.has three divisions: Resistors, Semiconductors

Q8: Use the information below to answer the

Q9: Answer the following question(s)using the information below:<br>Springfield

Q12: Use the information below to answer the

Q13: Use the information below to answer the

Q14: Imputed costs are costs recognized in particular

Q15: Use the information below to answer the

Q51: The three alternatives for increasing return on