Multiple Choice

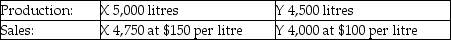

Use the information below to answer the following question(s) .Chem Manufacturing Company processes direct materials up to the splitoff point, where two products (X and Y) are obtained and sold.The following information was collected for the month of November.Direct materials processed:

10,000 litres (10,000 litres yield 9,500 litres of good product and 500 litres of shrinkage)

The cost of purchasing 10,000 litres of direct materials and processing it up to the splitoff point to yield a total of 9,500 litres of good products was $975,000.The beginning inventories totalled 50 litres for X and 25 litres for Y.Ending inventory amounts reflected 300 litres of product X and 525 litres of product Y.October costs were per unit were the same as November.

The cost of purchasing 10,000 litres of direct materials and processing it up to the splitoff point to yield a total of 9,500 litres of good products was $975,000.The beginning inventories totalled 50 litres for X and 25 litres for Y.Ending inventory amounts reflected 300 litres of product X and 525 litres of product Y.October costs were per unit were the same as November.

-Advantages of the sales value at splitoff method include all of the following EXCEPT

A) it does not presuppose an exact number of subsequent steps for further processing.

B) it uses a meaningful denominator.

C) there is no anticipation of subsequent management decisions.

D) it is simple.

E) the allocation of joint costs could lead managers to make poor decisions.

Correct Answer:

Verified

Correct Answer:

Verified

Q42: Helen Company processes 30,000 litres of direct

Q44: Salt Island Pottery Ltd.manufactures two products, bowls

Q45: Answer the following question(s)using the information below:<br>The

Q46: Match each of the following costs with

Q48: Separable costs are assignable after the splitoff

Q50: Answer the following question(s)using the information below.The

Q51: Use the information below to answer the

Q84: Separable costs include manufacturing costs only.

Q120: Distinguish between the two principal methods of

Q121: What are the two methods to account