Essay

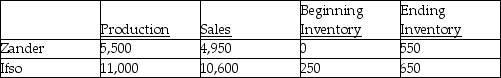

Helen Company processes 30,000 litres of direct materials to produce two products, Zander and Ifso.Zander, a byproduct, sells for $5 per litre, and Ifso, the main product, sells for $70 per litre.The following information is for July:

The manufacturing costs totalled $145,000; beginning inventory $3,000.Required:

The manufacturing costs totalled $145,000; beginning inventory $3,000.Required:

1.Prepare a July income statement assuming that Helen Company recognizes the byproduct net realizable value when production is completed.The company uses FIFO for the inventory flow assumption.2.Prepare the journal entry to record the byproduct sales.

Correct Answer:

Verified

1.Income statement

Cost of g...

Cost of g...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q37: Scrap frequently has a zero sales value.

Q38: Assigning joint costs when only a portion

Q39: Answer the following question(s)using the information below:<br>The

Q40: A byproduct has a minimal sales value.

Q41: Favata Corporation processes a single material into

Q44: Salt Island Pottery Ltd.manufactures two products, bowls

Q45: Answer the following question(s)using the information below:<br>The

Q46: Match each of the following costs with

Q47: Use the information below to answer the

Q121: What are the two methods to account