Multiple Choice

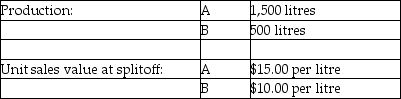

Use the information below to answer the following question(s) .Beverage Drink Company processes direct materials up to the splitoff point, where two products, A and B, are obtained.The following information was collected for the month of July:

Direct materials processed: 2,500 litres (with 20 percent shrinkage)

Cost of purchasing 2,500 litres of direct materials and processing it up to the splitoff point to yield a total of 2,000 litres of good products was $4,500.There were no inventory balances of A and B.Product A may be processed further to yield 1,375 litres of Product Z5 for an additional processing cost of $150.Product Z5 is sold for $25.00 per litre.There was no beginning inventory and ending inventory was 125 litres.Product B may be processed further to yield 375 litres of Product W3 for an additional processing cost of $275.Product W3 is sold for $30.00 per litre.There was no beginning inventory and ending inventory was 25 litres.

Cost of purchasing 2,500 litres of direct materials and processing it up to the splitoff point to yield a total of 2,000 litres of good products was $4,500.There were no inventory balances of A and B.Product A may be processed further to yield 1,375 litres of Product Z5 for an additional processing cost of $150.Product Z5 is sold for $25.00 per litre.There was no beginning inventory and ending inventory was 125 litres.Product B may be processed further to yield 375 litres of Product W3 for an additional processing cost of $275.Product W3 is sold for $30.00 per litre.There was no beginning inventory and ending inventory was 25 litres.

-All of the following statements about the constant gross margin percentage of net realizable method are true EXCEPT

A) all products have equal gross margin percentages.

B) it is based on a tenuous underlying assumption.

C) the gross margin percentage remains the same regardless of the different amounts of separable costs.

D) the gross margin is calculated by deducting all separable costs from revenue.

E) some products may receive negative allocations of joint costs.

Correct Answer:

Verified

Correct Answer:

Verified

Q2: Costs which are assignable beyond the splitoff

Q3: Use the information below to answer the

Q4: The selection of a joint cost allocation

Q5: Use the information below to answer the

Q7: Byproducts and scrap are differentiated by<br>A)number of

Q8: Santos Corporation processes a single material into

Q9: Which of the following is NOT a

Q10: Answer the following question(s)using the information below.The

Q11: BC Lumber processes timber into four products.During

Q127: List three reasons why we allocate joint