Essay

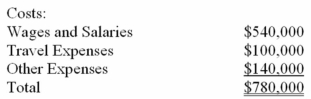

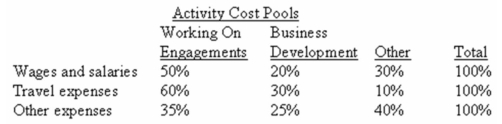

Fife & Jones PLC,a consulting firm,uses an activity-based costing in which there are three activity cost pools.The company has provided the following data concerning its costs and its activity-based costing system:

Distribution of Resource Consumption:

Required:

a)How much cost,in total,would be allocated to the Working On Engagements activity cost pool?

b)How much cost,in total,would be allocated to the Business Development activity cost pool?

c)How much cost,in total,would be allocated to the Other activity cost pool?

Correct Answer:

Verified

All three parts can be answere...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q17: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB1327/.jpg" alt=" -What would be

Q29: Managing and sustaining product diversity requires many

Q34: Koszyk Manufacturing Corporation has a

Q59: Jackson Painting paints the interiors and exteriors

Q61: Why may departmental overhead rates NOT correctly

Q63: Eaker Company uses activity-based costing to compute

Q65: Mike Kyekyeku is a sole proprietorship that

Q68: Which of the following would be classified

Q118: In the second-stage allocation in activity-based costing,activity

Q119: Addison Company has two products: