Essay

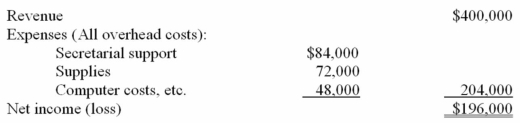

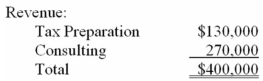

Mike Kyekyeku is a sole proprietorship that provides consulting and tax preparation services to its clients.Mike charges a fee of $100 per hour for each service and can devote a maximum of 4,000 hours annually to his clients.He reported the following revenues and expenses for 2014:

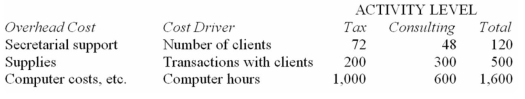

Being an accountant,Mike kept good records of the following data for 2014:

(i).

(ii).

Required:

a.Should Mike emphasize one service more than the other if Mike were to allocate all the overhead costs using direct-labours as the only overhead cost driver (1,300 for Tax and 2,700 for Consulting)? Support your decision with the relevant calculations and/or analysis.

b.Identify each of the three cost drivers as either unit-level,batch-level,product-level,customer-level,or organization-sustaining.

c.How might Mike's product/service emphasis decision in Part a above be altered if he were to allocate all the overhead costs using activity-based costing and the three cost drivers,that is,number of clients,number of transactions with clients,and computer hours? Show all your supporting calculations and/or analysis,including any necessary explanation.

Correct Answer:

Verified

a.

Decision:No

Analysis and/or calculati...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

Decision:No

Analysis and/or calculati...

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q17: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB1327/.jpg" alt=" -What would be

Q41: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB1327/.jpg" alt=" -What would be

Q45: Unit-level production activities are performed each time

Q61: Why may departmental overhead rates NOT correctly

Q62: Fife & Jones PLC,a consulting firm,uses an

Q63: Eaker Company uses activity-based costing to compute

Q68: Which of the following would be classified

Q118: In the second-stage allocation in activity-based costing,activity

Q119: Addison Company has two products:

Q125: Abel Company uses activity-based costing.