Multiple Choice

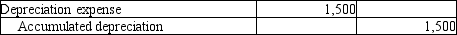

On December 31, 2012, the adjusting entry for depreciation was made incorrectly. The following is the entry which was made erroneously:  The correct amount of depreciation should have been $5,100. Consider the effects of this error on the balance sheet, and identify which of the following statements is TRUE.

The correct amount of depreciation should have been $5,100. Consider the effects of this error on the balance sheet, and identify which of the following statements is TRUE.

A) Total liabilities are overstated by $3,600.

B) Total liabilities are understated by $3,600.

C) Total assets are overstated by $3,600.

D) Total assets are understated by $3,600.

Correct Answer:

Verified

Correct Answer:

Verified

Q30: Generally accepted accounting principles require the use

Q57: How do the adjusting entries differ from

Q65: The accountant for Wilson Consulting Company failed

Q71: Classic Artists' Services has hired a maintenance

Q71: Hank's Tax Planning Service has the following

Q74: The table below represents Able Company's supplies

Q82: Pattie's Event Planning Service records prepaid expenses

Q89: The accountant for Barnes Architectural Services failed

Q113: The accountant for Jones Auto Repair Company

Q159: Employees of Robert Rogers,CPA worked during the