Essay

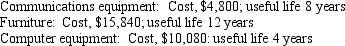

Hank's Tax Planning Service has the following plant assets:

Hank's monthly depreciation entry will include a:

Hank's monthly depreciation entry will include a:

A)debit to depreciation expense of $210.

B)credit to depreciation expense of $370.

C)debit to Accumulated Depreciation of $210.

D)credit to Accumulated Depreciation of $370.

Correct Answer:

Verified

Correct Answer:

Verified

Q18: The accountant for Hobson Electrical Repair Company

Q28: The accountant for Duman Legal Services failed

Q30: Generally accepted accounting principles require the use

Q66: A business pays its employees' monthly salaries

Q71: Classic Artists' Services has hired a maintenance

Q74: The table below represents Able Company's supplies

Q76: On December 31, 2012, the adjusting entry

Q109: Adjusting entries NEVER involve:<br>A) expenses.<br>B) cash.<br>C) liabilities.<br>D)

Q122: The financial statements should be prepared in

Q159: Employees of Robert Rogers,CPA worked during the