Essay

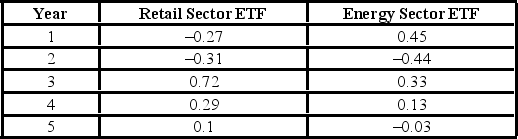

The following is return data for a retail sector ETF and energy sector ETF for the years, Year 1 to Year 5.  (See the Excel Data File.)

(See the Excel Data File.)

A) What is the arithmetic mean return for each ETF?

B) What is the geometric mean return for each ETF?

C) What is the sample standard deviation for each ETF? Which ETF was riskier over this time period?

D) Given a risk free rate of 5%, what is the Sharpe Ratio for each ETF? Which investment had a better return per unit of risk over this time period?

Correct Answer:

Verified

a) Arithmetic Mean Retail =AVERAGE() = 0...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q9: Amounts spent by a sample of 200

Q10: In quality control settings, businesses prefer a

Q11: The arithmetic mean is the middle value

Q12: The sample data below shows the number

Q13: Which of the following is the most

Q15: Yearly returns (rounded to the nearest percent)

Q16: Which of the following is not true

Q17: When working with grouped data, the class

Q18: A portfolio's annual total returns (in percent)

Q19: Consider a population with data values of